when will i get my mn unemployment tax refund

Another way is to check your tax transcript if you have an online account with the IRS. The agency issued tax refunds worth 145 billion to over 118 million households as of Dec.

When Will Irs Send Unemployment Tax Refunds 11alive Com

I havent received my unemployment tax refund from 2020 when the bill passed in 2021 I had already filed my taxes.

. If you received unemployment in 2020 the federal government decided up to 10200 of that money would be tax free to help people out during the pandemic. We know these refunds are important to those taxpayers who have. But a lot of people still.

When will i get my mn unemployment tax refund. September 30 2021 249 PM. On September 13Th The State Of Minnesota Started Processing Refunds To Those That Had Paid Income Tax On The First 10200 On Their Unemployment Income.

Hello Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point. If the IRS has your banking information on file youll receive. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns.

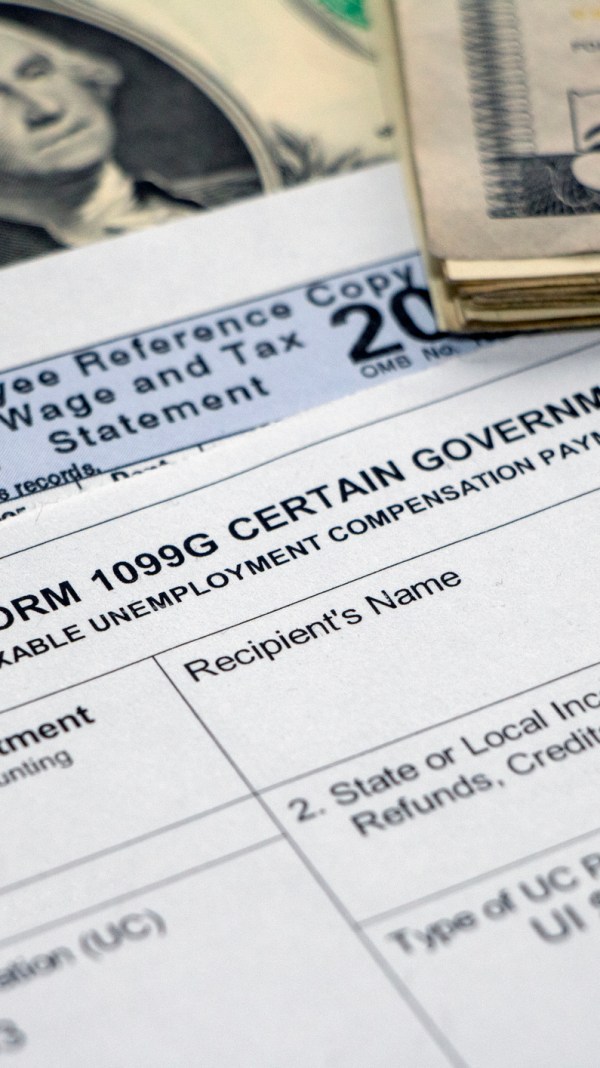

PAUL WCCO Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in. 22 2022 Published 742 am. We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31 2022.

Law Change FAQs for 2020 updated 101021 Webinar Script September 15 2020. When will I get my unemployment tax refund. 2020 Individual and Business Tax Form Updates.

Wednesday April 27 2022. You do not need to take any action if you file for unemployment and qualify for the adjustment. Some of the information on the following FAQ pages may be outdated due to Minnesota tax law changes enacted July 1 2021.

The new law reduces the. By Anuradha Garg. Weve finished adjusting 2020 minnesota tax returns affected only by law changes to the treatment of unemployment insurance ui compensation and paycheck protection program.

Sadly you cant track the cash in the way you can track other tax refunds. Additional Assessment for 2022 from 1400 to 000. When will I get my unemployment tax refund.

View step-by-step instructions for accessing your 1099-G. Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans.

Minnesota Department of Revenue set to begin processing Unemployment Insurance and Paycheck Protection Program refunds. Benefits can help to keep your family afloat so you can meet expenses until you find work again. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill.

It is too late to change your address for the 1099-G mailing but you can access your 1099-G online. Direct deposit refunds started going out Wednesday and paper checks today. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. For this round the average refund is 1686. When Should I Expect My Tax Refund In 2022.

As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. Were reviewing this content. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13.

Most should receive them within 21 days of when they file electronically if they choose direct deposit. Base Tax Rate for 2022 from 050 to 010. About 500000 Minnesotans are in line to get.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. In response the US. The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds.

IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. The IRS anticipates most taxpayers will receive refunds as in past years.

On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. On September 13Th The State Of Minnesota Started Processing Refunds To Those That Had Paid Income Tax On The First 10200 On Their Unemployment Income. Weve finished adjusting 2020 minnesota tax returns affected only by law changes to the treatment of unemployment insurance ui compensation and paycheck protection program.

When will i get my mn unemployment tax refund Thursday April 21 2022 Edit - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. At the onset of the coronavirus pandemic the American economy immediately fell into recession with unemployment spiking to 148 the highest since records began in 1948. Minnesota Department of Revenue Mail Station 5510 600 N.

How To Claim Unemployment Benefits H R Block

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Unemployment Tax Refund Could Put Thousands Back In Your Pocket

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

No 10 200 Unemployment Tax Break In 13 States Could Mean Higher Taxes

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

10 200 Unemployment Tax Break When Married Couples Should File Separately

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

What You Need To Know About Unemployment Tax Refunds And When You Ll Get It

10 200 In Unemployment Benefits Won T Be Taxed Leading To Confusion Amid Tax Filing Season Cbs News

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Minnesota Mn Unemployment Tax Tpa Instructions

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

When Will Irs Send Unemployment Tax Refunds 11alive Com

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest